1099 S Certification Exemption Form

1099 S Certification Exemption Form - If you have already paid the real estate tax for. Your land title sales representative can. If the seller properly completes parts i and iii,. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. Typically, the irs requires certification of these six items. Web shows certain real estate tax on a residence charged to the buyer at settlement.

InfoTrack — How to place a 1099S order

If you have already paid the real estate tax for. If the seller properly completes parts i and iii,. Your land title sales representative can. Typically, the irs requires certification of these six items. Web shows certain real estate tax on a residence charged to the buyer at settlement.

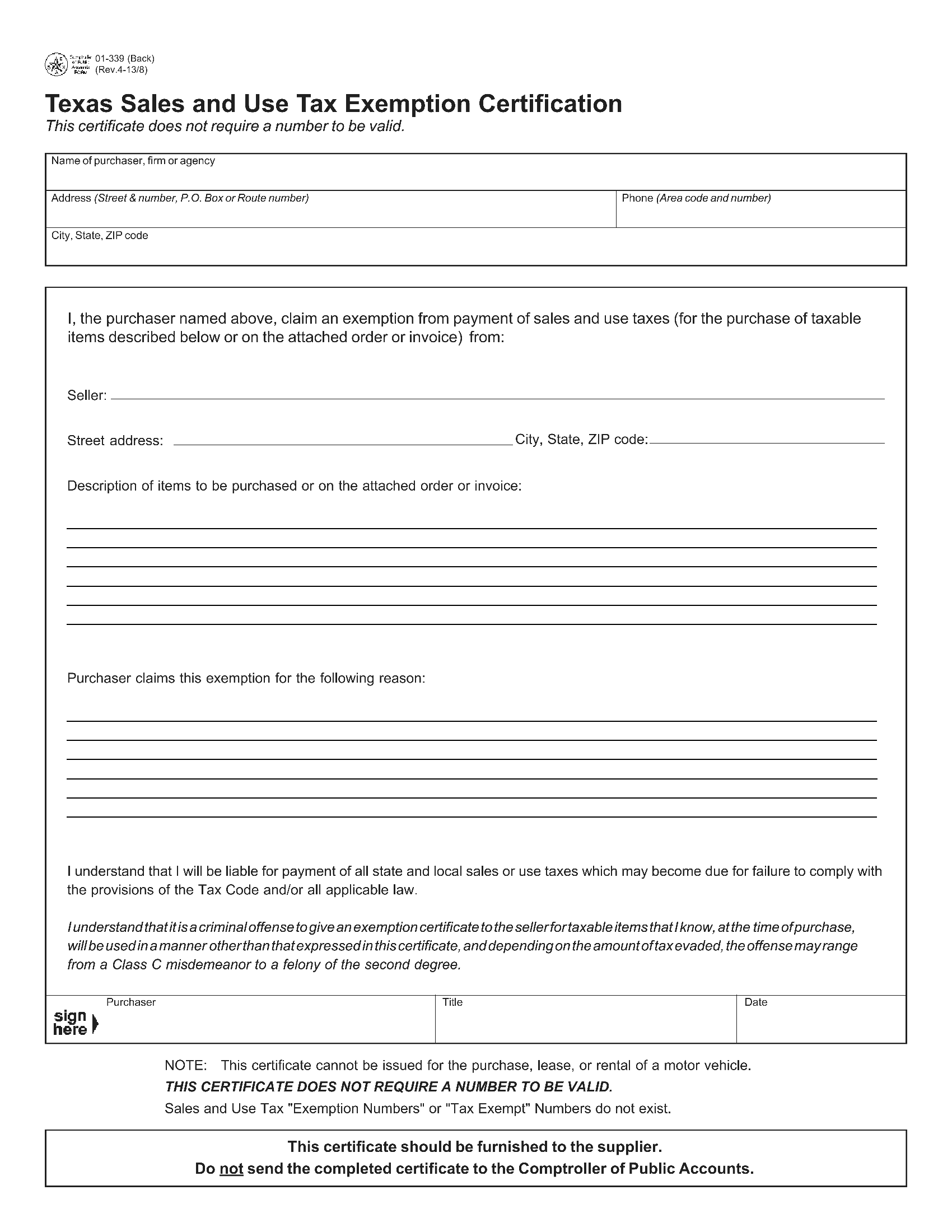

Texas Sales and Use Tax Exemption Certification Forms Docs 2023

Web shows certain real estate tax on a residence charged to the buyer at settlement. If the seller properly completes parts i and iii,. If you have already paid the real estate tax for. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. Typically, the irs requires certification of these six items.

Irs Form 1099S Certification Exemption Form printable pdf download

If the seller properly completes parts i and iii,. Web shows certain real estate tax on a residence charged to the buyer at settlement. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. Your land title sales representative can. If you have already paid the real estate tax for.

Paid Family and Medical Leave exemption requests, registration, contributions, and payments

Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. If the seller properly completes parts i and iii,. Typically, the irs requires certification of these six items. Your land title sales representative can. If you have already paid the real estate tax for.

Certification of No Information Reporting on Sale or Exchange of Principal Residence 1099 S

Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. Typically, the irs requires certification of these six items. If you have already paid the real estate tax for. If the seller properly completes parts i and iii,. Your land title sales representative can.

2018 IRS Tax Form 1099S single sheet set for 3 transferors carbonless 3part Office Equipment

If the seller properly completes parts i and iii,. Your land title sales representative can. Web shows certain real estate tax on a residence charged to the buyer at settlement. Typically, the irs requires certification of these six items. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6.

1099S Forms for Real Estate Proceeds, Transferor Copy B ZBPforms

If you have already paid the real estate tax for. Web shows certain real estate tax on a residence charged to the buyer at settlement. If the seller properly completes parts i and iii,. Typically, the irs requires certification of these six items. Your land title sales representative can.

1099s certification exemption form Fill online, Printable, Fillable Blank

If you have already paid the real estate tax for. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. Web shows certain real estate tax on a residence charged to the buyer at settlement. If the seller properly completes parts i and iii,. Your land title sales representative can.

Free IRS 1099S Form PDF eForms

If you have already paid the real estate tax for. Typically, the irs requires certification of these six items. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. If the seller properly completes parts i and iii,. Web shows certain real estate tax on a residence charged to the buyer at settlement.

1099 S Fillable Form Printable Forms Free Online

If you have already paid the real estate tax for. Web shows certain real estate tax on a residence charged to the buyer at settlement. If the seller properly completes parts i and iii,. Your land title sales representative can. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6.

If you have already paid the real estate tax for. Your land title sales representative can. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. If the seller properly completes parts i and iii,. Typically, the irs requires certification of these six items. Web shows certain real estate tax on a residence charged to the buyer at settlement.

Your Land Title Sales Representative Can.

Web shows certain real estate tax on a residence charged to the buyer at settlement. If the seller properly completes parts i and iii,. Web there are additional reporting exemptions under part ii “seller assurances” 1 through 6. If you have already paid the real estate tax for.