2024 Schedule B Form 941

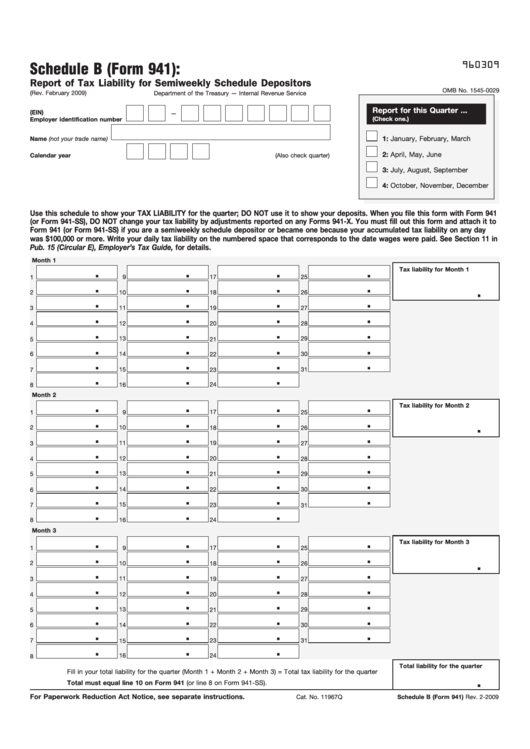

2024 Schedule B Form 941 - Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Schedule b, report of tax liability. Web learn how to file schedule b for form 941, an attachment that provides detailed information on the tax liabilities. Web the irs released the 2024 form 941, employer’s quarterly federal tax return; Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for. When you file this form. If you have employees, you likely need to fill out and file form 941 each quarter. Web use this schedule to show your tax liability for the quarter; This guide provides the basics. Web most businesses must report and file tax returns quarterly using the irs form 941.

Printable Schedule B Form 941 Fillable Form 2023 vrogue.co

Don't use it to show your deposits. Web learn how to file schedule b for form 941, an attachment that provides detailed information on the tax liabilities. Web the irs released the 2024 form 941, employer’s quarterly federal tax return; Schedule b, report of tax liability. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors,.

Schedule B Form 941 For 2024 Beulah Evangelina

Don't use it to show your deposits. Web the irs released the 2024 form 941, employer’s quarterly federal tax return; Web use this schedule to show your tax liability for the quarter; Web what is irs form 941 schedule b? Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

File Form 941 Online for 2024 How to Efile 941

This guide provides the basics. Web most businesses must report and file tax returns quarterly using the irs form 941. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Don't use it to show your deposits. Schedule b, report of tax liability.

941 V 20142024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Web the irs released the 2024 form 941, employer’s quarterly federal tax return; This guide provides the basics. Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for. When you file this form. Web most businesses must report and file tax returns quarterly using the irs form 941.

Form 941 Schedule B 2024 Monthly Korry Mildrid

Web what is irs form 941 schedule b? Web use this schedule to show your tax liability for the quarter; If you have employees, you likely need to fill out and file form 941 each quarter. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. When you file this.

IRS Form 941 Schedule B 2024

This guide provides the basics. Schedule b, report of tax liability. When you file this form. Web the irs released the 2024 form 941, employer’s quarterly federal tax return; Web use this schedule to show your tax liability for the quarter;

941vi Fill Online, Printable, Fillable, Blank pdfFiller

Don't use it to show your deposits. If you have employees, you likely need to fill out and file form 941 each quarter. Web use this schedule to show your tax liability for the quarter; Web most businesses must report and file tax returns quarterly using the irs form 941. Web the irs released the 2024 form 941, employer’s quarterly.

941 Forms 2024 Neysa Adrienne

Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for. Web most businesses must report and file tax returns quarterly using the irs form 941. When you file this form. Web use this schedule to show your tax liability for the quarter; This guide provides the basics.

Form 941 Schedule B YouTube

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web use this schedule to show your tax liability for the quarter; Web most businesses must report and file tax returns quarterly using the irs form 941. Web what is irs form 941 schedule b? This guide provides the basics.

941 Form Schedule B 2024 Alta

Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for. Web what is irs form 941 schedule b? Web use this schedule to show your tax liability for the quarter; Don't use it to show your deposits. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it.

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web use this schedule to show your tax liability for the quarter; Web the irs released the 2024 form 941, employer’s quarterly federal tax return; When you file this form. Web what is irs form 941 schedule b? Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for. Web most businesses must report and file tax returns quarterly using the irs form 941. Don't use it to show your deposits. Web learn how to file schedule b for form 941, an attachment that provides detailed information on the tax liabilities. This guide provides the basics. If you have employees, you likely need to fill out and file form 941 each quarter. Schedule b, report of tax liability.

This Guide Provides The Basics.

If you have employees, you likely need to fill out and file form 941 each quarter. When you file this form. Don't use it to show your deposits. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941.

Web Use This Schedule To Show Your Tax Liability For The Quarter;

Web what is irs form 941 schedule b? Web most businesses must report and file tax returns quarterly using the irs form 941. Web the irs released the 2024 form 941, employer’s quarterly federal tax return; Schedule b, report of tax liability.

Web Learn How To File Schedule B For Form 941, An Attachment That Provides Detailed Information On The Tax Liabilities.

Schedule b, which accompanies form 941, is a daily report of the employer's tax liability for.