California Form 100-Es Pay Online

California Form 100-Es Pay Online - Make a payment on your existing balance due. Third quarter estimated tax vouchers with zero balance. Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Secretary of state (sos) certification penalty payment. Quarterly estimated tax payment percentages are: 2023 fourth quarter estimated tax payments due for individuals. You can pay online using. Web pay a bill or notice.

2019 Form CA FTB 100ES Fill Online, Printable, Fillable, Blank pdfFiller

Make a payment on your existing balance due. Third quarter estimated tax vouchers with zero balance. You can pay online using. Quarterly estimated tax payment percentages are: Secretary of state (sos) certification penalty payment.

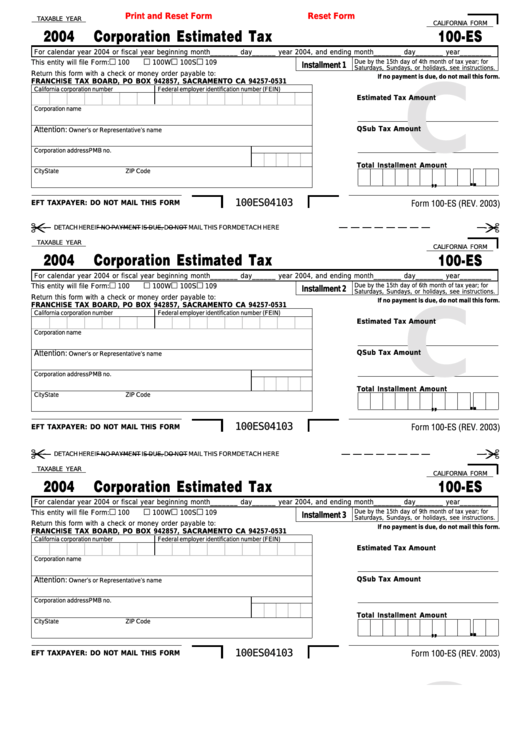

Fillable California Form 100Es Corporation Estimated Tax 2004 printable pdf download

Quarterly estimated tax payment percentages are: Web pay a bill or notice. You can pay online using. Secretary of state (sos) certification penalty payment. 2023 fourth quarter estimated tax payments due for individuals.

Form 100S S Corporation Franchise or Tax Return (California)

2023 fourth quarter estimated tax payments due for individuals. Quarterly estimated tax payment percentages are: Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. You can pay online using. Third quarter estimated tax vouchers with zero balance.

Form 100S Download Fillable PDF or Fill Online California S Corporation Franchise or Tax

Make a payment on your existing balance due. Quarterly estimated tax payment percentages are: 2023 fourth quarter estimated tax payments due for individuals. Secretary of state (sos) certification penalty payment. Web pay a bill or notice.

Fillable Online Form 100ES Download Fillable PDF or Fill Online Fax Email Print pdfFiller

Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Secretary of state (sos) certification penalty payment. Quarterly estimated tax payment percentages are: Make a payment on your existing balance due. 2023 fourth quarter estimated tax payments due for individuals.

Form 100ES Download Fillable PDF or Fill Online Corporation Estimated Tax 2022, California

Quarterly estimated tax payment percentages are: Third quarter estimated tax vouchers with zero balance. 2023 fourth quarter estimated tax payments due for individuals. Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Make a payment on your existing balance due.

Instructions For Form 100Es Corporation Estimated Tax 2017 printable pdf download

Third quarter estimated tax vouchers with zero balance. Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. 2023 fourth quarter estimated tax payments due for individuals. Quarterly estimated tax payment percentages are: Make a payment on your existing balance due.

Form 100 Es 2023 Printable Forms Free Online

Third quarter estimated tax vouchers with zero balance. Make a payment on your existing balance due. 2023 fourth quarter estimated tax payments due for individuals. You can pay online using. Secretary of state (sos) certification penalty payment.

Form SI100 Download Fillable PDF or Fill Online Statement of Information (California Nonprofit

Make a payment on your existing balance due. Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Quarterly estimated tax payment percentages are: 2023 fourth quarter estimated tax payments due for individuals. Third quarter estimated tax vouchers with zero balance.

Form 100 Schedule P Download Fillable PDF or Fill Online Alternative Minimum Tax and Credit

Secretary of state (sos) certification penalty payment. You can pay online using. Quarterly estimated tax payment percentages are: Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Make a payment on your existing balance due.

You can pay online using. Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Third quarter estimated tax vouchers with zero balance. 2023 fourth quarter estimated tax payments due for individuals. Make a payment on your existing balance due. Web pay a bill or notice. Secretary of state (sos) certification penalty payment. Quarterly estimated tax payment percentages are:

Web Pay A Bill Or Notice.

You can pay online using. Quarterly estimated tax payment percentages are: Web this form is for corporations to pay estimated tax for taxable year 2024 in four installments. Make a payment on your existing balance due.

2023 Fourth Quarter Estimated Tax Payments Due For Individuals.

Secretary of state (sos) certification penalty payment. Third quarter estimated tax vouchers with zero balance.