Colorado Tax Form 104Pn

Colorado Tax Form 104Pn - Nonresidents of colorado who need to file income taxes in the state need to file. You may file by mail with paper. This form apportions your gross. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. This form apportions your gross. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Web printable colorado income tax form 104pn. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web use this form if you and/or your spouse were a resident of another state for all or part of 2021.

Fill Free fillable Form 104PN PartYear Resident/Nonresident Tax Calculation Schedule 2020

You may file by mail with paper. Web use this form if you and/or your spouse were a resident of another state for all or part of 2021. Nonresidents of colorado who need to file income taxes in the state need to file. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web.

Colorado form 104pn Fill out & sign online DocHub

You may file by mail with paper. We will update this page with a new version of. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. This form apportions your gross.

Form 104 colorado Fill out & sign online DocHub

This form apportions your gross. Nonresidents of colorado who need to file income taxes in the state need to file. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. You may file by mail with paper. Web this form is for income earned in tax year 2023, with.

CO Form 104 Instructions PDF Tax In The United States Irs Tax Forms

This form apportions your gross. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. You may file by mail with paper. Web form 104 is the general, and simplest, income.

Individual Tax Form 104 Colorado Free Download

This form apportions your gross. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. Web use this form if you and/or your spouse were a resident of another state for all or part of 2021. You may file by mail with paper. Nonresidents of colorado who need to.

Printable Colorado Tax Form 104 Fill And Sign vrogue.co

You may file by mail with paper. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. This form apportions your gross. This form apportions your gross.

Printable Colorado Tax Form 104 Printable Forms Free Online

This form apportions your gross. Web use this form if you and/or your spouse were a resident of another state for all or part of 2021. Web printable colorado income tax form 104pn. This form apportions your gross. Web this form is for income earned in tax year 2023, with tax returns due in april 2024.

Colorado Form Tax Fill Out and Sign Printable PDF Template airSlate SignNow

You may file by mail with paper. Nonresidents of colorado who need to file income taxes in the state need to file. Web printable colorado income tax form 104pn. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104 is the general, and simplest, income tax return.

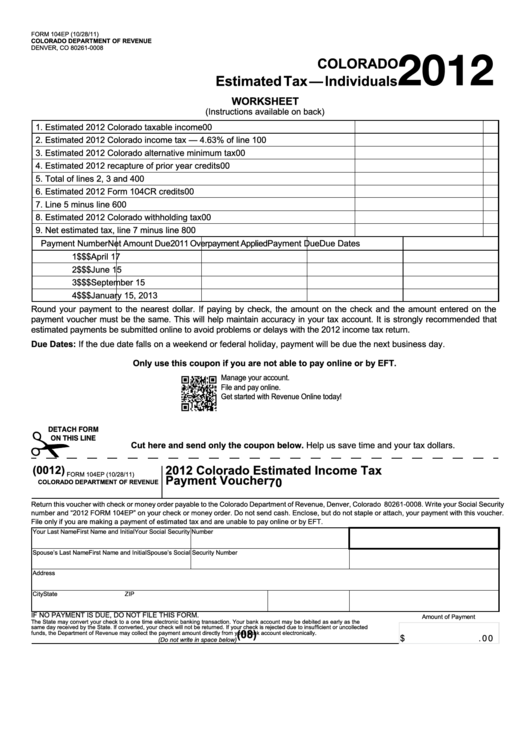

Form 104ep Colorado TaxIndividuals Worksheet 2012 printable pdf download

Web printable colorado income tax form 104pn. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. This form apportions your gross. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. We will update this page with a new version of.

Colorado 104pn Form Fill Out and Sign Printable PDF Template signNow

Nonresidents of colorado who need to file income taxes in the state need to file. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web printable colorado income tax form 104pn. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. Web.

Web form 104 is the general, and simplest, income tax return for individual residents of colorado. We will update this page with a new version of. This form apportions your gross. You may file by mail with paper. This form apportions your gross. Web printable colorado income tax form 104pn. Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Nonresidents of colorado who need to file income taxes in the state need to file. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web use this form if you and/or your spouse were a resident of another state for all or part of 2021.

Nonresidents Of Colorado Who Need To File Income Taxes In The State Need To File.

Web use this form if you and/or your spouse were a resident of another state for all or part of 2021. Web tax is prorated so that it is calculated only on income received in colorado or from sources within colorado. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. This form apportions your gross.

We Will Update This Page With A New Version Of.

Web use this form if you and/or your spouse were a resident of another state for all or part of 2016. This form apportions your gross. Web this form is for income earned in tax year 2023, with tax returns due in april 2024. Web printable colorado income tax form 104pn.