Cp503 Irs Form

Cp503 Irs Form - Web received a cp503 notice from the irs? Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web irs notice cp503 is the 2nd notice of a balance due. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. It explains your due date, amount due, and payment options. It is one of the most common notices that the irs sends out to. We’ll help you understand your tax. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Learn how to respond effectively, explore payment options, and.

IRS Form 501(c)(3) Definition Finance Strategists

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. It is one of the most common notices that the irs sends out to. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. Web received a cp503 notice from the irs? Pay online.

NUMBER CRUNCHER LLC on Twitter "What do the IRS letters mean? Read today's blog post to find

Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Pay online or mail a check or money. It is one of the most common notices.

IRS Form 8919 ≡ Fill Out Printable PDF Forms Online

Learn how to respond effectively, explore payment options, and. We’ll help you understand your tax. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. It explains your due date, amount due, and payment options. Pay online or mail a check or money.

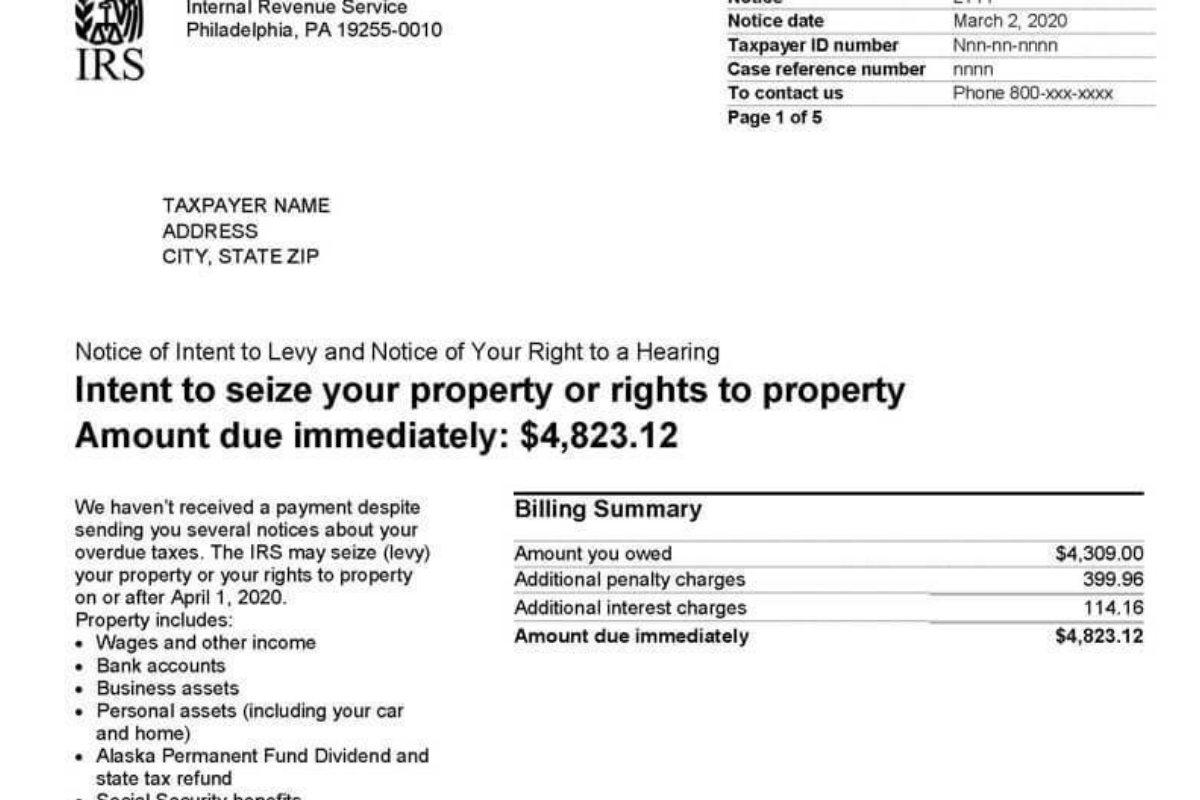

IRS Audit Letter CP503 Sample 1

Learn how to respond effectively, explore payment options, and. Web irs notice cp503 is the 2nd notice of a balance due. It is one of the most common notices that the irs sends out to. Pay online or mail a check or money. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income.

IRS Notice CP503 Second Reminder for Unpaid Taxes H&R Block

Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Pay online or mail a check or money. Web irs notice cp503 is the 2nd notice.

IRS Form 3520 ≡ Fill Out Printable PDF Forms Online

Web received a cp503 notice from the irs? Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. We’ll help you understand your tax. Pay online or mail a check or money. It explains your due date, amount due, and payment options.

Understanding your CP503 Notice

Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Learn how to respond effectively, explore payment options, and. Web what you need to do. We’ll help you understand your tax. Pay online or mail a check or money.

Understanding IRS Collections Notices. CP501, CP503, and CP504 YouTube

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. We’ll help you understand your tax. It explains your due date, amount due, and payment options. Pay online or mail a check or money. It is one of the most common notices that the irs sends out to.

IRS Resumes Collection Letters CP501 CP503 CP504 YouTube

We’ll help you understand your tax. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Web irs notice cp503 is the 2nd notice of a.

IRS Audit Letter CP503 Sample 1

Web what you need to do. It explains your due date, amount due, and payment options. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Pay online or mail a check or money. Web the irs sends cp503 to remind you that an unpaid balance remains on your.

Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you. Web the irs sends cp503 to remind you that an unpaid balance remains on your individual income tax return for the year indicated. Web irs notice cp503 is the 2nd notice of a balance due. Learn how to respond effectively, explore payment options, and. It explains your due date, amount due, and payment options. Web what you need to do. Web taxpayers receive irs notice cp503 if they neglect their tax debts for too long. We’ll help you understand your tax. It is one of the most common notices that the irs sends out to. Web received a cp503 notice from the irs? Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. Pay online or mail a check or money.

Web Taxpayers Receive Irs Notice Cp503 If They Neglect Their Tax Debts For Too Long.

Web received a cp503 notice from the irs? Pay online or mail a check or money. It is one of the most common notices that the irs sends out to. Web the notice cp503 (also referred to as the 2nd notice) informs you that there is a balance due (money you.

Web The Irs Sends Cp503 To Remind You That An Unpaid Balance Remains On Your Individual Income Tax Return For The Year Indicated.

We’ll help you understand your tax. Learn how to respond effectively, explore payment options, and. Web pay the amount due of $9,533.53 by january 29, 2018, to avoid additional interest and applicable penalty charges. It explains your due date, amount due, and payment options.

Web What You Need To Do.

Web irs notice cp503 is the 2nd notice of a balance due.