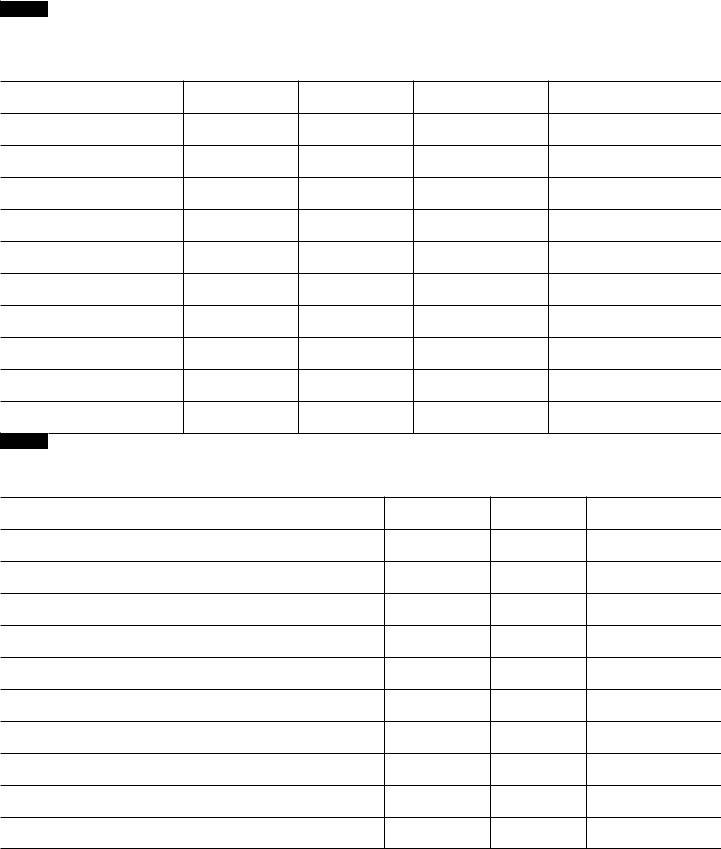

Form 1120 Schedule G

Form 1120 Schedule G - Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web form 1120 is the u.s. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. It includes schedule g, which reports the income,. Corporate income tax return for certain entities. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web schedule g (form 1120) requires corporations to disclose information on the ownership structure, specifically. Web form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or.

Fillable Schedule G (Form 1120) Information On Certain Persons Owning The Corporation'S Voting

Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web form 1120 is the u.s. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. It includes schedule g, which reports the income,. Web form 1120 schedule g reports on certain transactions.

Create Fillable Form 1120 With Us Fastly, Easyly, And Securely

Web form 1120 is the u.s. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. It includes schedule g, which reports the income,. Web form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or. Web use schedule g (form 1120) to provide information.

Form 1120 Schedule G Fillable Printable Forms Free Online

Web form 1120 is the u.s. Web schedule g (form 1120) requires corporations to disclose information on the ownership structure, specifically. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. It.

form 1120 schedule g 2015

Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web form 1120 is.

General InstructionsPurpose of FormUse Schedule G (Form...

Corporate income tax return for certain entities. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. It includes schedule g, which reports the income,. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web use schedule g (form 1120) to.

1120 Schedule G ≡ Fill Out Printable PDF Forms Online

Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or. Web form 1120 is the u.s. Web schedule g (form 1120) requires corporations to disclose information on the ownership structure, specifically. Web use.

How to Fill Out Form 1120 for 2021. StepbyStep Instructions

Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Corporate income tax return for certain entities. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. It includes schedule g, which reports the income,. Web form 1120 schedule g reports on.

irs form 1120 schedule g

Web form 1120 is the u.s. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Corporate income tax return for certain entities. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web use schedule g (form 1120) to provide information.

irs form 1120 schedule g

Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. It includes schedule g, which reports the income,. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Corporate income tax return for certain entities. Web form 1120 is the u.s.

General InstructionsPurpose of FormUse Schedule G (Form...

Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web form 1120 is the u.s. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates.

Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or. Web form 1120 is the u.s. It includes schedule g, which reports the income,. Corporate income tax return for certain entities. Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web schedule g (form 1120) requires corporations to disclose information on the ownership structure, specifically.

Web Form 1120 Is The U.s.

Web use schedule g (form 1120) to provide information applicable to certain entities, individuals, and estates that own,. Web form 1120 schedule g reports on certain transactions and relationships a corporation has with other entities or. Web schedule g is one of the schedules that domestic corporations use to report their income, gains, losses, deductions,. Web schedule g (form 1120) requires corporations to disclose information on the ownership structure, specifically.

It Includes Schedule G, Which Reports The Income,.

Corporate income tax return for certain entities. Web under the 20% direct or 50% direct/indirect owners section, use the percentage constructively owned, if different field to.