Form 2220 Instructions

Form 2220 Instructions - Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax payments for taxes attributable to a. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web learn how to complete form 2220 to determine if you owe a penalty for underpaying your estimated tax for 2023. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220.

Fillable Online 2007 Instructions for Form 2220 Underpayment of Estimated Tax by Corporations

Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax payments for taxes attributable to a. Web learn how to complete form 2220 to.

Instructions for Form 2220 Underpayment of Estimated Tax by Corporations Fill Out and Sign

Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax payments for taxes attributable to a. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax by Corporations PDF, 2022

Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web for tax.

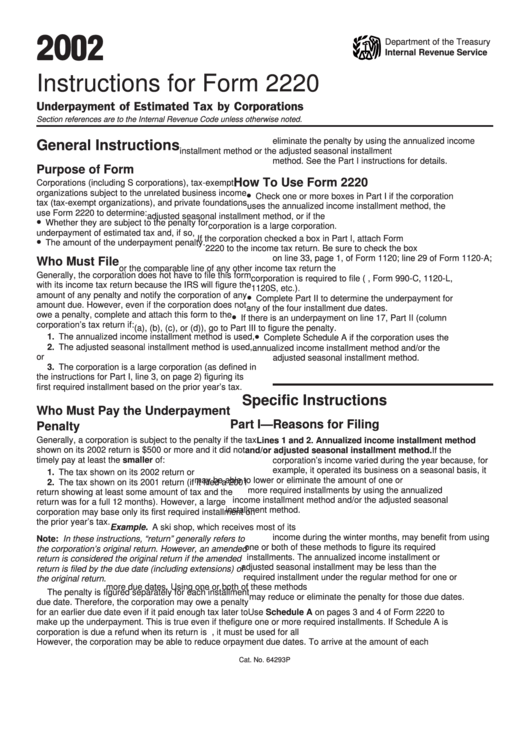

Instructions For Form 2220 2002 printable pdf download

Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web generally, the.

Download Instructions for IRS Form 2220 Underpayment of Estimated Tax by Corporations PDF, 2022

Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs.

Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations 2014 printable pdf

Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web learn how to complete form 2220 to determine if you owe a penalty for underpaying your estimated tax for 2023..

How to avoid a penalty using Form 2220?

Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web for tax year 2023, the irs will waive the penalty for failure.

Download Instructions for Form DP2210/2220 Exceptions and Penalty for the Underpayment of

Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web information about form 2220, underpayment of estimated tax by corporations, including recent.

Download Instructions for Form CRO2220 48hour Notice PDF Templateroller

Web learn how to complete form 2220 to determine if you owe a penalty for underpaying your estimated tax for 2023. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax.

Instructions For Form 2220 Underpayment Of Estimated Tax By Corporations 2004 printable pdf

Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web generally, the.

Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220. Web learn how to complete form 2220 to determine if you owe a penalty for underpaying your estimated tax for 2023. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax payments for taxes attributable to a. Web generally, the corporation is not required to file form 2220 (see part ii below for exceptions) because the irs will figure any penalty owed and bill the corporation. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web form 2220 is used by corporations to calculate the interest rate and amount of underpayment penalty for.

Web Generally, The Corporation Is Not Required To File Form 2220 (See Part Ii Below For Exceptions) Because The Irs Will Figure Any Penalty Owed And Bill The Corporation.

Web learn how to complete form 2220 to determine if you owe a penalty for underpaying your estimated tax for 2023. Web for tax year 2023, the irs will waive the penalty for failure to make estimated tax payments for taxes attributable to a. Web information about form 2220, underpayment of estimated tax by corporations, including recent updates, related forms, and. Web use this form to enter information for any waiver amount to be subtracted from the total underpayment penalty of form 2220.