Form 3514 Business Code Must Be Entered

Form 3514 Business Code Must Be Entered - Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Effective january 1, 2021, taxpayers who have an individual. It could refer to a. Web this business code can be found on any of your business activities not only on a schedule c. Web california is requesting form 3514 line 18 wanting business information. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? Web the form 3514 requests a business code, business license number and sein. How do i clear this to efile? If you don't have a sein or business. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for.

Ftb3514 20152024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

It could refer to a. Web this business code can be found on any of your business activities not only on a schedule c. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal.

Employer settlement on 1099misc. TT making it self employed

Web the form 3514 requests a business code, business license number and sein. Effective january 1, 2021, taxpayers who have an individual. If you don't have a sein or business. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc,.

20202024 Form FDA 3514 Fill Online, Printable, Fillable, Blank pdfFiller

Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web the form 3514 requests a business code, business license number and sein. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. How do.

AARP TaxAide WA District 18 Schedule C Business Codes

Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web california is requesting form 3514 line 18 wanting business information. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web how do i enter a.

Fill Free fillable 2016 Instructions for Form FTB 3514 (California) PDF form

It could refer to a. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web this business code can be found on any of.

3514 Business Code 20222024 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. If you don't have a sein or business. How do i clear this to efile? Web this business code can be found on any of your business activities not only on a schedule c. Effective january 1, 2021,.

2016 Form 3514 California Earned Tax Credit Edit, Fill, Sign Online Handypdf

Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web for example, a taxpayer may be classified as an independent contractor for federal purposes,.

Va Life Insurance Application Form Financial Report

How do i clear this to efile? Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web this business code can be found on any of your business activities not only on a schedule c. Web 603 rows for example, a taxpayer may be classified as.

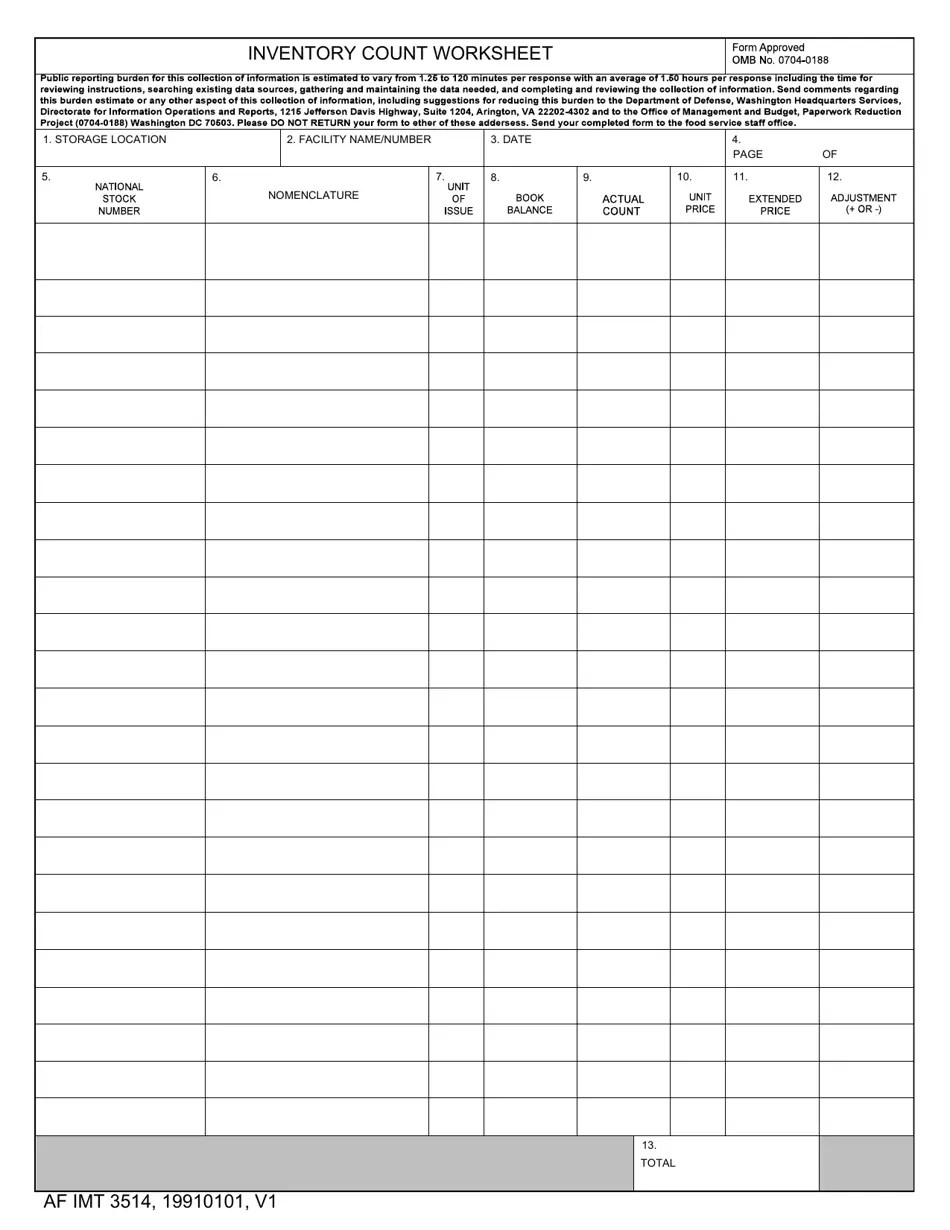

AF IMT Form 3514 Fill Out, Sign Online and Download Fillable PDF Templateroller

Web california is requesting form 3514 line 18 wanting business information. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. It could refer to a. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee.

Instructions for Form 990T (2016) Internal Revenue Service

Web california is requesting form 3514 line 18 wanting business information. Web this business code can be found on any of your business activities not only on a schedule c. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. If you don't have a sein or.

Web this business code can be found on any of your business activities not only on a schedule c. Web the form 3514 requests a business code, business license number and sein. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web california is requesting form 3514 line 18 wanting business information. Effective january 1, 2021, taxpayers who have an individual. Web how do i enter a business code on ca state form 3514, when i don't have a federal 1040 sch c? How do i clear this to efile? Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. It could refer to a. If you don't have a sein or business.

If You Don't Have A Sein Or Business.

Web the form 3514 requests a business code, business license number and sein. It could refer to a. Web california is requesting form 3514 line 18 wanting business information. How do i clear this to efile?

Effective January 1, 2021, Taxpayers Who Have An Individual.

Web this business code can be found on any of your business activities not only on a schedule c. Web for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for. Web learn how to claim the refundable california eitc, yctc, and fytc by filing a california income tax return and attaching form ftb. Web 603 rows for example, a taxpayer may be classified as an independent contractor for federal purposes, but as an employee for.