Form 4797 Vs 8949

Form 4797 Vs 8949 - Web should i use form 8949 or 4797 when reporting the sale of my rental property? Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; Web should you use form 8949 or form 4797? Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through. When reporting gains from the sale of real estate , form 4797 will suffice. It usually depends on the property’s nature. Form 4797 is not used to report the sale of investments or inventory. Web form 8949 is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year.

Irs Form 4797 Instructions 2022 Fill online, Printable, Fillable Blank

Form 4797 is not used to report the sale of investments or inventory. Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through. Web should.

IRS Form 4797 walkthrough (Sales of Business Property) YouTube

Web form 8949 is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year. Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; Form 4797 is not used to report the sale of.

2019 Form IRS 4797 Fill Online, Printable, Fillable, Blank pdfFiller

When reporting gains from the sale of real estate , form 4797 will suffice. Web should you use form 8949 or form 4797? Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; It usually depends on the property’s nature. Web most deals are reportable with form 4797, but some.

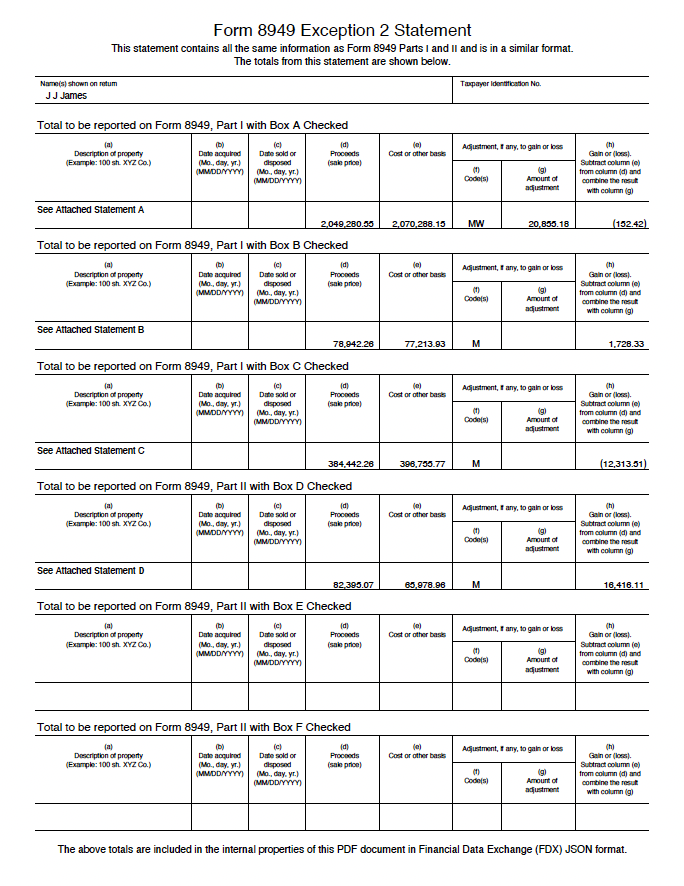

Form 8949 Exception 2 When Electronically Filing Form 1040

Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. It usually depends on the property’s nature. Form 4797 is not used to report the sale of investments or inventory. Web should you use form 8949 or form 4797? Web form 8949 is a required addition to.

Form 4797 Fill Out and Sign Printable PDF Template signNow

It usually depends on the property’s nature. Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. Web should you use form 8949 or form 4797? Form 4797 is not used to report the sale of investments or inventory. When reporting gains from the sale of real.

IRS Form 8949 Instructions

Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; Web should you use form 8949 or form 4797? It usually depends on the property’s nature. When reporting gains from the sale of real estate , form 4797 will suffice. Web should i use form 8949 or 4797 when reporting.

Explanation of IRS Form 8949 Exception 2

Web form 8949 is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year. It usually depends on the property’s nature. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through. Web.

IRS Form 8949 Instructions

Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. Web should you use form 8949 or form 4797? When reporting gains from the sale of real estate , form 4797 will suffice. Web should i use form 8949 or 4797 when reporting the sale of my.

Instructions for Form 4797 Internal Revenue Service Fill Out and Sign Printable PDF Template

Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. It usually depends on the property’s nature. Form 4797 is not used to report the sale of investments or inventory. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral.

How to Import Intelligent Form 8949 Statements into Tax Software

It usually depends on the property’s nature. Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. Web most deals are reportable with form 4797, but some.

Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule; Web form 8949 is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through. Web should i use form 8949 or 4797 when reporting the sale of my rental property? Web should you use form 8949 or form 4797? Web report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949,. When reporting gains from the sale of real estate , form 4797 will suffice. Form 4797 is not used to report the sale of investments or inventory. It usually depends on the property’s nature.

Web Report The Gain Or Loss On The Sale Of Rental Property On Form 4797, Sales Of Business Property Or On Form 8949,.

Web should i use form 8949 or 4797 when reporting the sale of my rental property? It usually depends on the property’s nature. Form 4797 is not used to report the sale of investments or inventory. Web use form 8949, to report the sale or exchange of capital assets not reported on another form or schedule;

Web Should You Use Form 8949 Or Form 4797?

When reporting gains from the sale of real estate , form 4797 will suffice. Web most deals are reportable with form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through. Web form 8949 is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year.