Form Uia 1028

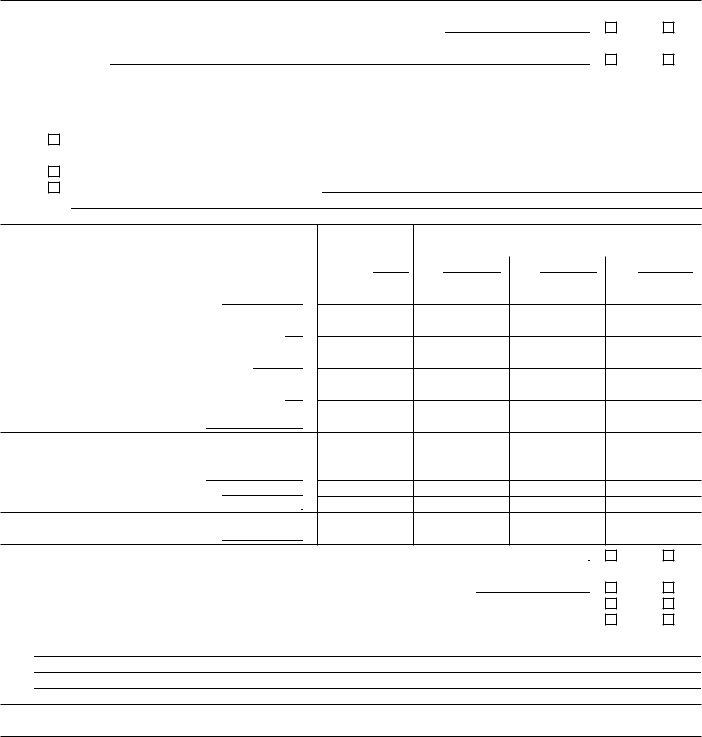

Form Uia 1028 - Fill out the employer's quarterly wage/tax. Web late reporting and payments can increase your unemployment tax rate. Web wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax report, which must be submitted to the michigan. Web what is uia form 1028? Web there are two methods for taxing employers for unemployment insurance. The exact formula for calculating the rate is. If you recently filed form. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your.

Uia Form 1028 ≡ Fill Out Printable PDF Forms Online

Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Web late reporting and payments can increase your unemployment tax rate. The exact formula for calculating the rate is. If you recently filed form. Web what is uia form 1028?

Uia 1028 Printable Form Printable Forms Free Online

If you recently filed form. Web late reporting and payments can increase your unemployment tax rate. Web what is uia form 1028? Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Web wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax.

Michigan Uia 1028 amulette

Web there are two methods for taxing employers for unemployment insurance. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Fill out the employer's quarterly wage/tax. The exact formula for calculating the rate is. Web late reporting and payments can increase your unemployment tax rate.

Form 1028 ≡ Fill Out Printable PDF Forms Online

The exact formula for calculating the rate is. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web there are two methods for taxing employers for unemployment insurance. Web late reporting and payments can increase your unemployment tax rate. Fill out the employer's quarterly wage/tax.

Form uia 1028 Fill out & sign online DocHub

The exact formula for calculating the rate is. If you recently filed form. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Fill out the employer's quarterly wage/tax. Web late reporting and payments can increase your unemployment tax rate.

Uia Form 1028 ≡ Fill Out Printable PDF Forms Online

Web what is uia form 1028? Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web late reporting and payments can increase your unemployment tax rate. Web there are two methods for taxing employers for unemployment insurance. If you recently filed form.

2019 Form MI UIA 1925 Fill Online, Printable, Fillable, Blank pdfFiller

Web there are two methods for taxing employers for unemployment insurance. Web late reporting and payments can increase your unemployment tax rate. The exact formula for calculating the rate is. Web what is uia form 1028? Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to.

20192024 Form MI UIA 1733 Fill Online, Printable, Fillable, Blank pdfFiller

If you recently filed form. Web wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax report, which must be submitted to the michigan. Fill out the employer's quarterly wage/tax. Web there are two methods for taxing employers for unemployment insurance. Web what is uia form 1028?

Fillable Form Uia 1028 Employer'S Quarterly Wage/tax Report Michigan Department Of Licensing

Web late reporting and payments can increase your unemployment tax rate. The exact formula for calculating the rate is. If you recently filed form. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. Web what is uia form 1028?

Fillable Online Uia 1028 Form Fill Out and Sign Printable PDF Template Fax Email Print pdfFiller

If you recently filed form. Web there are two methods for taxing employers for unemployment insurance. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web what is uia form 1028? The exact formula for calculating the rate is.

Web late reporting and payments can increase your unemployment tax rate. Fill out the employer's quarterly wage/tax. Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax report, which must be submitted to the michigan. Web what is uia form 1028? Web there are two methods for taxing employers for unemployment insurance. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. If you recently filed form. The exact formula for calculating the rate is.

Fill Out The Employer&Amp;#039;S Quarterly Wage/Tax.

Form uia 1028, employer's quarterly wage/tax report wage detail information must be provided for every covered employee to. Web for the next 10 calendar days you may submit form uia 1028 and make tax or reimbursement payments through your. If you recently filed form. Web there are two methods for taxing employers for unemployment insurance.

Web What Is Uia Form 1028?

Web wage/tax report (uia 1028) these instructions explain how to create and submit the uia 1028 wage/tax report, which must be submitted to the michigan. The exact formula for calculating the rate is. Web late reporting and payments can increase your unemployment tax rate.