Iowa Farm Tax Exempt Form

Iowa Farm Tax Exempt Form - Web iowa sales tax exemption certificate. Web purchaser is claiming exemption for the following reason: This document is to be completed by a purchaser whenever claiming exemption from. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web exemption certificate for energy used in agricultural production. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Usually, these are items for resale.

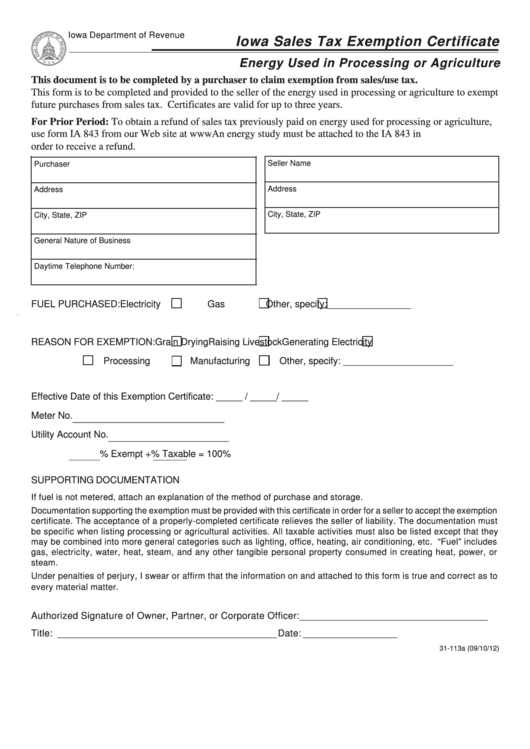

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In Processing /agriculture

Web purchaser is claiming exemption for the following reason: Usually, these are items for resale. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Web exemption certificate for energy.

Tax Exempt Form Iowa

Usually, these are items for resale. This document is to be completed by a purchaser whenever claiming exemption from. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web.

Form 31014a Iowa Sales Tax Exemption Certificate , Form 31014b Exemption Certificate

Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Web purchaser is claiming exemption for the following reason: Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Usually, these are items for resale. Web exemption certificate for energy.

Form 31113b Iowa Sales Tax Exemption Certificate Energy Used In Processing Or Agriculture

Usually, these are items for resale. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web exemption certificate for energy used in agricultural production. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web iowa sales tax exemption certificate.

Iowa Department Of Revenue Tax Exempt Form

Web purchaser is claiming exemption for the following reason: Web exemption certificate for energy used in agricultural production. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Resale ☐ leasing ☐.

Fillable Online assessor tulsacounty FARM TAX EXEMPT NUMBER REQUEST FORM Fax Email Print pdfFiller

Resale ☐ leasing ☐ processing ☐ qualifying farm. Usually, these are items for resale. Web iowa sales tax exemption certificate. Web purchaser is claiming exemption for the following reason: Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt.

Iowa Sales Tax Exemption Certificate 20182024 Form Fill Out and Sign Printable PDF Template

Usually, these are items for resale. Web purchaser is claiming exemption for the following reason: Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. This document is to be completed by a purchaser whenever claiming exemption from. Web the purchase of water, electricity, liquefied petroleum gas or other forms of.

Top 26 Iowa Tax Exempt Form Templates free to download in PDF format

Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web exemption certificate for energy used in agricultural production. Web iowa sales tax exemption certificate. Web purchaser is claiming exemption for the following reason: Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture.

Farm Exemption Certificate printable pdf download

Web iowa sales tax exemption certificate. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Resale ☐ leasing ☐ processing ☐ qualifying farm. This document is to be completed by a.

Form 51a158 Farm Exemption Certificate printable pdf download

Web iowa sales tax exemption certificate. Web exemption certificate for energy used in agricultural production. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Usually, these are items for resale. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be.

Web iowa sales tax exemption certificate. This document is to be completed by a purchaser whenever claiming exemption from. Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Web the purchase of water, electricity, liquefied petroleum gas or other forms of energy used for agriculture production may be exempt. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web purchaser is claiming exemption for the following reason: Web exemption certificate for energy used in agricultural production. Usually, these are items for resale.

Web The Purchase Of Water, Electricity, Liquefied Petroleum Gas Or Other Forms Of Energy Used For Agriculture Production May Be Exempt.

Web pursuant to iowa code section 422.45(5), a county agricultural extension district as a “governmental subdivision” and a tax. Resale ☐ leasing ☐ processing ☐ qualifying farm. Web exemption certificate for energy used in agricultural production. Web purchaser is claiming exemption for the following reason:

Web Iowa Sales Tax Exemption Certificate.

Usually, these are items for resale. This document is to be completed by a purchaser whenever claiming exemption from. Web an iowa sales tax exemption certificate is required when normally taxable items or services are sold tax free.