Irs 1127 Form

Irs 1127 Form - Web in this article, we’ll help you better understand irs form 1127, including: Web there’s a special form for this situation: How to complete and file irs form 1127 ;. If you file form 1127 and the irs. Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. Advisory group manager) for the area where you maintain your legal. Irs form 1127, application for extension of time for payment of tax due to undue. Web file form 1127 with the internal revenue service (attn: Web use form 1127 to request an extension of time under internal revenue code section 6161 for payment of the. Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit.

Fillable Online 2011 Form 1127A IRS tax forms Fax Email Print pdfFiller

How to complete and file irs form 1127 ;. Web there’s a special form for this situation: If you file form 1127 and the irs. Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. Advisory group manager) for the area where you maintain your legal.

Form 1127 IRS Payment Extension A Comprehensive Guide to Filing and Approval finally

Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit. Web in this article, we’ll help you better understand irs form 1127, including: Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties.

IRS Form 1127 walkthrough YouTube

How to complete and file irs form 1127 ;. Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit. Web most.

Form 1127 Example Return (2024) IRS Form 1127 What It Is, How to Fill It Out 💰 TAXES S5•E178

Web file form 1127 with the internal revenue service (attn: Web use form 1127 to request an extension of time under internal revenue code section 6161 for payment of the. How to complete and file irs form 1127 ;. Irs form 1127, application for extension of time for payment of tax due to undue. Web form 1127 offers an extension.

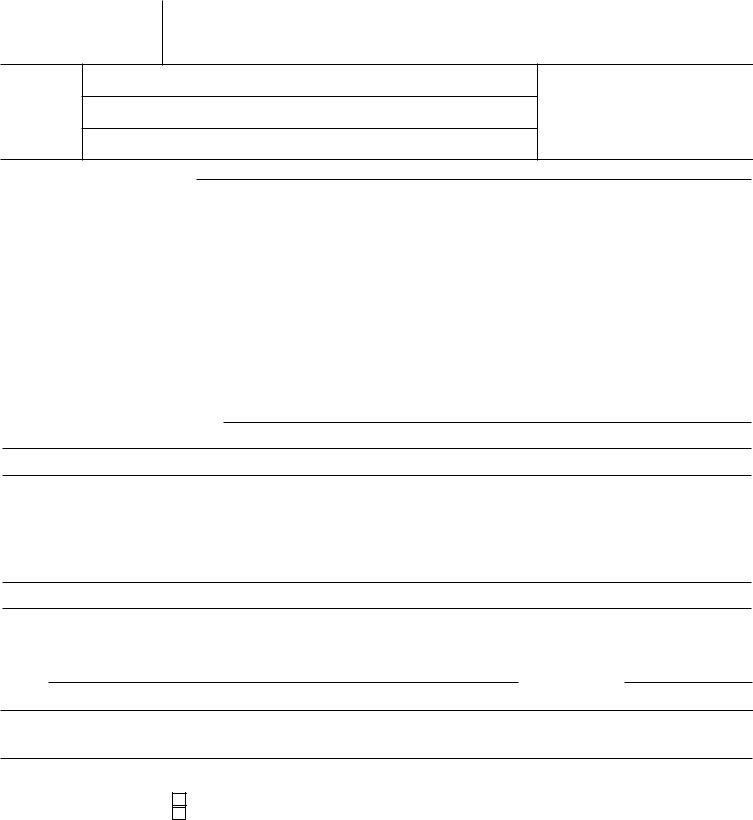

Form 1127 ≡ Fill Out Printable PDF Forms Online

Irs form 1127, application for extension of time for payment of tax due to undue. How to complete and file irs form 1127 ;. Web most new york city employees living outside of the five boroughs (hired on or after january 4, 1973) must file form nyc. Web in this article, we’ll help you better understand irs form 1127, including:.

IRS Form 1127 Download Fillable PDF or Fill Online Application for Extension of Time for Payment

If you file form 1127 and the irs. Web use form 1127 to request an extension of time under internal revenue code section 6161 for payment of the. Web file form 1127 with the internal revenue service (attn: Advisory group manager) for the area where you maintain your legal. How to complete and file irs form 1127 ;.

5.1.12 Cases Requiring Special Handling Internal Revenue Service

Web in this article, we’ll help you better understand irs form 1127, including: Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit. How to complete and file irs form 1127 ;. The extension allows up to six months to pay. Web by.

IRS Form 1127 Download Fillable PDF or Fill Online Application for Extension of Time for Payment

Irs form 1127, application for extension of time for payment of tax due to undue. How to complete and file irs form 1127 ;. Web file form 1127 with the internal revenue service (attn: Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. Web most new york.

IRS 1127A 2011 Fill out Tax Template Online US Legal Forms

Web there’s a special form for this situation: If you file form 1127 and the irs. Web file form 1127 with the internal revenue service (attn: Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit. Web form 1127 offers an extension of.

Form Nyc1127 Return For Nonresident Employees Of The City Of New York Hired On Or After

Web most new york city employees living outside of the five boroughs (hired on or after january 4, 1973) must file form nyc. How to complete and file irs form 1127 ;. Web file form 1127 with the internal revenue service (attn: Web form 1127 offers an extension of time for taxpayers facing financial hardships. Web in this article, we’ll.

Web most new york city employees living outside of the five boroughs (hired on or after january 4, 1973) must file form nyc. Web file form 1127 with the internal revenue service (attn: The extension allows up to six months to pay. If you file form 1127 and the irs. Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit. Advisory group manager) for the area where you maintain your legal. Irs form 1127, application for extension of time for payment of tax due to undue. Web form 1127 offers an extension of time for taxpayers facing financial hardships. Web use form 1127 to request an extension of time under internal revenue code section 6161 for payment of the. How to complete and file irs form 1127 ;. Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. Web in this article, we’ll help you better understand irs form 1127, including: Web there’s a special form for this situation:

Web File Form 1127 With The Internal Revenue Service (Attn:

Advisory group manager) for the area where you maintain your legal. Web most new york city employees living outside of the five boroughs (hired on or after january 4, 1973) must file form nyc. If you file form 1127 and the irs. How to complete and file irs form 1127 ;.

Web Form 1127 Offers An Extension Of Time For Taxpayers Facing Financial Hardships.

Web by filing form 1127, taxpayers can request an extension of time to pay the taxes due without incurring penalties or interest. The extension allows up to six months to pay. Web in this article, we’ll help you better understand irs form 1127, including: Web you can use form 1127 to request an extension of time to pay the tax due with your return or additional tax due after an audit.

Web Use Form 1127 To Request An Extension Of Time Under Internal Revenue Code Section 6161 For Payment Of The.

Web there’s a special form for this situation: Irs form 1127, application for extension of time for payment of tax due to undue.