Irs Form 2119

Irs Form 2119 - If you replaced your main home within the replacement period, also use. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. Since that time, you can not defer capital gains. Web if you meet all of the requirements, you can exclude the gain on the sale of your home by filing form 2119. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Web form 2119 was discontinued by the taxpayer relief act of 1997. Web use form 2119 to report the sale of your main home. Web this is a pdf document of the 1994 version of irs form 2119, which is used to report the gain or loss from the sale of your home. The form was used even if the taxpayer postponed all or part of the gain.

How to Complete an IRS W9 Form YouTube

Since that time, you can not defer capital gains. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. The form was used even if the taxpayer postponed all or part of the gain. Web if you meet all of the requirements, you can exclude the gain on the.

Form L2119 Motor Fuel Suppliers Monthly User Fee And Fee Calculation printable pdf download

Web form 2119 was discontinued by the taxpayer relief act of 1997. Web if you meet all of the requirements, you can exclude the gain on the sale of your home by filing form 2119. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. Web this is a.

Form 2119 Download Fillable PDF or Fill Online Contribution Acknowledgement Texas Templateroller

You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. If you replaced your main home within the replacement period, also use. Web use form 2119 to report the sale of your main home. Web this publication explains the tax rules that apply when you sell (or otherwise give.

IRS 211 2018 Fill and Sign Printable Template Online US Legal Forms

The form was used even if the taxpayer postponed all or part of the gain. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Web use form 2119 to report the sale of your main home. You'll use irs schedule d and form 8949 to report your sale proceeds.

OCR Form Processing Guide]

Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. If you replaced your main home within the replacement period, also use. Web form 2119 was discontinued by the taxpayer relief act of 1997. Web use form 2119 to report the sale of your main home. The form was used.

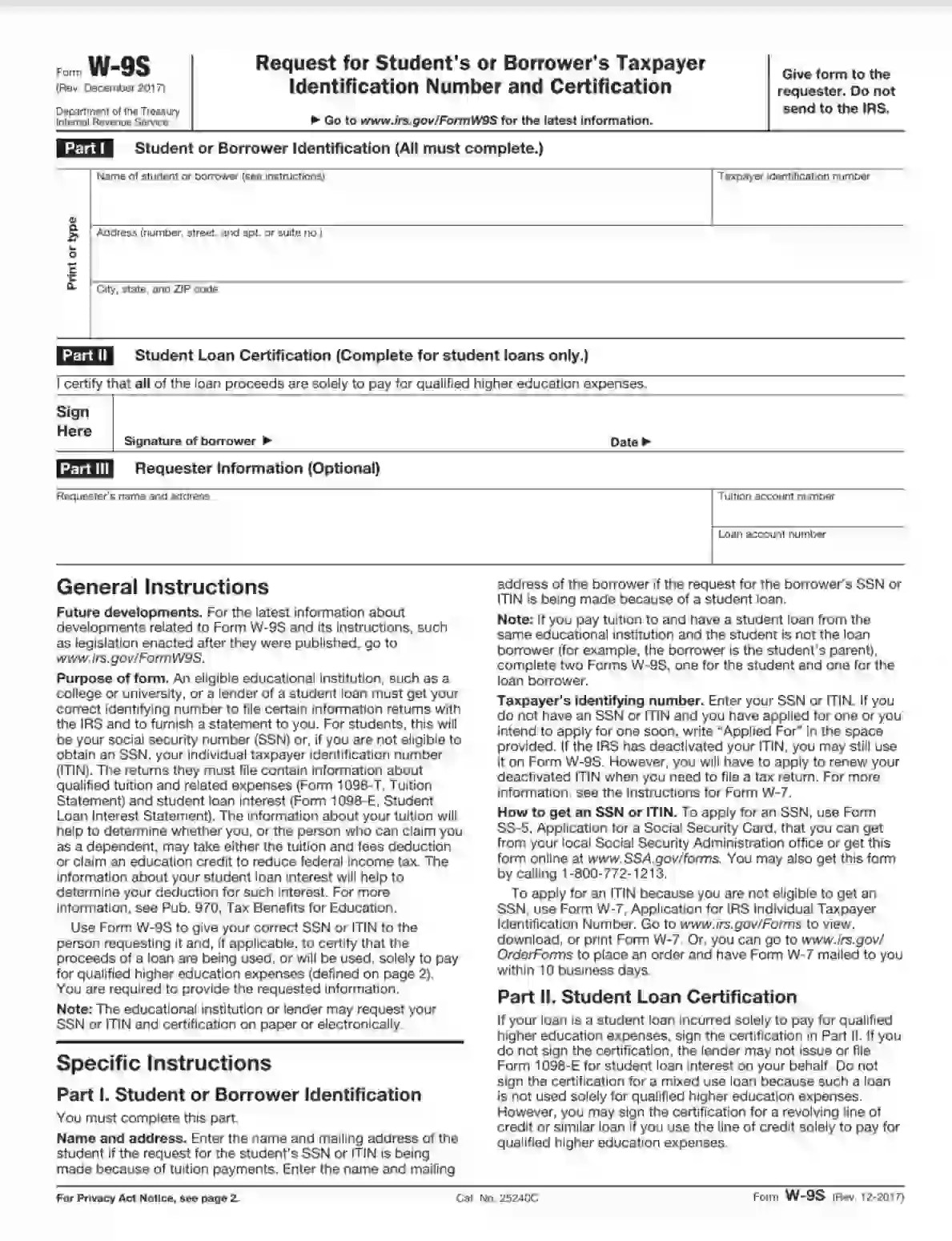

IRS Form W9S ≡ Fill Out Printable PDF Forms Online

If you replaced your main home within the replacement period, also use. Web form 2119 was discontinued by the taxpayer relief act of 1997. Web this is a pdf document of the 1994 version of irs form 2119, which is used to report the gain or loss from the sale of your home. You'll use irs schedule d and form.

EDGAR Filing Documents for 000149315219013273

Web if you meet all of the requirements, you can exclude the gain on the sale of your home by filing form 2119. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. If you replaced your main home within the replacement period, also use. Since that time, you can.

Renters Are People Too! “ ppt video online download

Web use form 2119 to report the sale of your main home. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. If you replaced your main home within the replacement period, also use. Web form 2119 was discontinued by the taxpayer relief act of 1997. The form was.

Top Irs Form 2119 Templates free to download in PDF format

Since that time, you can not defer capital gains. Web if you meet all of the requirements, you can exclude the gain on the sale of your home by filing form 2119. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Web use form 2119 to report the sale.

Form 2119 ≡ Fill Out Printable PDF Forms Online

The form was used even if the taxpayer postponed all or part of the gain. Web this is a pdf document of the 1994 version of irs form 2119, which is used to report the gain or loss from the sale of your home. Web if you meet all of the requirements, you can exclude the gain on the sale.

Web form 2119 was discontinued by the taxpayer relief act of 1997. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Web this is a pdf document of the 1994 version of irs form 2119, which is used to report the gain or loss from the sale of your home. The form was used even if the taxpayer postponed all or part of the gain. If you replaced your main home within the replacement period, also use. Since that time, you can not defer capital gains. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible. Web use form 2119 to report the sale of your main home. Web if you meet all of the requirements, you can exclude the gain on the sale of your home by filing form 2119.

Web If You Meet All Of The Requirements, You Can Exclude The Gain On The Sale Of Your Home By Filing Form 2119.

The form was used even if the taxpayer postponed all or part of the gain. Web this publication explains the tax rules that apply when you sell (or otherwise give up ownership of) a home. Since that time, you can not defer capital gains. You'll use irs schedule d and form 8949 to report your sale proceeds and claim any exclusion for which you're eligible.

Web Form 2119 Was Discontinued By The Taxpayer Relief Act Of 1997.

If you replaced your main home within the replacement period, also use. Web this is a pdf document of the 1994 version of irs form 2119, which is used to report the gain or loss from the sale of your home. Web use form 2119 to report the sale of your main home.

![OCR Form Processing Guide]](https://i2.wp.com/global-uploads.webflow.com/64be86eaa29fa71f24b00685/64be86eaa29fa71f24b00ea4_61af7d25b98cf04a8ecab3f9_IRS%2520Forms%25402x.jpeg)