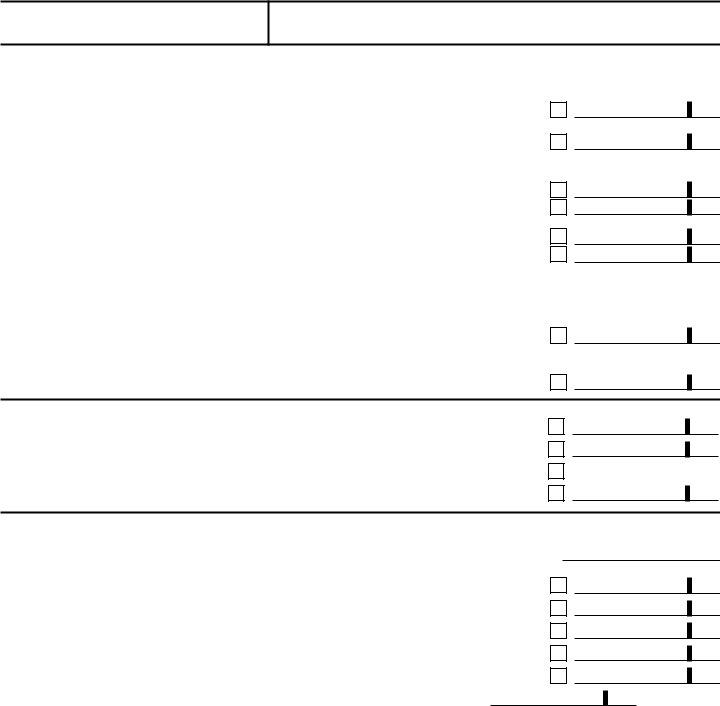

Maryland Form 502Cr

Maryland Form 502Cr - Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. This is the maryland tax based on your. Or line 11, form 504). Web credit for income tax paid to other state and/or locality. Your credit for taxes paid to another state and/or locality is the smaller. Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web enter the maryland tax (sum of lines 21 and 21a, form 502; I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in 502cr part aa (income tax credit) and not in part bb (local income tax credit) Web form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Web maryland form 502cr:

Fill Free fillable forms Comptroller of Maryland

Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. This is the maryland tax based on your total. I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in.

Maryland Form 502CR Fill and sign online with Lumin

Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. Web maryland form 502cr: This is the maryland tax based on your. Web credit for income tax paid to other state and/or locality. Web form 502cr is used to claim.

Maryland Form 502CR Fill and sign online with Lumin

Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web credit for income tax paid to other state and/or locality. This is the maryland tax based on your total. I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in 502cr part aa (income.

Fillable Maryland Form 502 Resident Tax Return 2015 printable pdf download

I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in 502cr part aa (income tax credit) and not in part bb (local income tax credit) Web credit for income tax paid to other state and/or locality. Web maryland form 502cr: Web form 502cr is used to claim personal income.

Instructions For Maryland Form 502cr Tax Credits For Individuals 2015 printable pdf

Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web credit for income tax paid to other state and/or locality. Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. Web form 502cr is.

Fillable Online Maryland Form 502CR (Maryland Personal Tax Credits for Fax Email

Web credit for income tax paid to other state and/or locality. Web enter the maryland tax (sum of lines 21 and 21a, form 502; Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Your credit for taxes paid to another state and/or locality is the smaller. This is the maryland tax based on your.

Maryland Form 502Cr ≡ Fill Out Printable PDF Forms Online

This is the maryland tax based on your. Web form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). This is the maryland tax based on your total. Web credit for income tax paid to other state and/or locality. This is the maryland tax based on your.

Fillable Form 502cr Personal Tax Credits For Individuals 2001 printable pdf download

Web maryland form 502cr: Your credit for taxes paid to another state and/or locality is the smaller. Web enter the maryland tax from line 21, form 502 (or line 11, form 504). This is the maryland tax based on your. This is the maryland tax based on your total.

Fillable Form 502cr Maryland Tax Credits For Individuals 2009 printable pdf download

Web credit for income tax paid to other state and/or locality. Web form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. I entered local.

502CR Maryland Tax Forms and Instructions

Web form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries). Or line 11, form 504). Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. I entered local income tax paid to pa to.

I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in 502cr part aa (income tax credit) and not in part bb (local income tax credit) Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. Web maryland form 502cr: This is the maryland tax based on your. This is the maryland tax based on your. Or line 11, form 504). Web enter the maryland tax (sum of lines 21 and 21a, form 502; Web credit for income tax paid to other state and/or locality. Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web enter the maryland tax from line 21, form 502 (or line 11, form 504). This is the maryland tax based on your total. Your credit for taxes paid to another state and/or locality is the smaller. Web form 502cr is used to claim personal income tax credits for individuals (including resident fiduciaries).

Web Credit For Income Tax Paid To Other State And/Or Locality.

I entered local income tax paid to pa to get credit in md, but in the forms, the credit shows in 502cr part aa (income tax credit) and not in part bb (local income tax credit) Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web enter the maryland tax from line 21, form 502 (or line 11, form 504). Web enter the maryland tax (sum of lines 21 and 21a, form 502;

Web Form 502Cr Is Used To Claim Personal Income Tax Credits For Individuals (Including Resident Fiduciaries).

Web a person who is domiciled in maryland and who is subject to tax as a resident of any of the states listed in group i or ii can claim. Web maryland form 502cr: Or line 11, form 504). This is the maryland tax based on your total.

This Is The Maryland Tax Based On Your.

This is the maryland tax based on your. Your credit for taxes paid to another state and/or locality is the smaller.