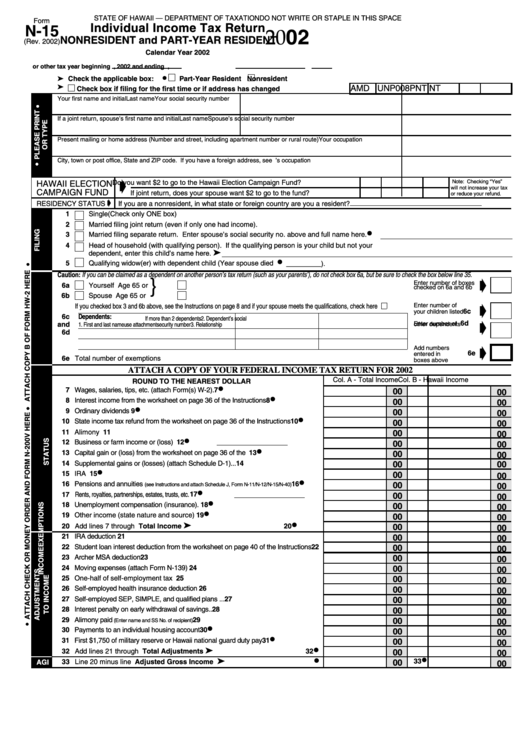

N-15 Form

N-15 Form - Web form state of hawaii department of taxation 1 t (rev. 2014) art c 2014 or nol ear t thru for office use only b. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n.

PPT to GWRRA Rider Education’s PowerPoint Presentation, free download ID6665996

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a.

Form N11 (N15) Schedule X 2019 Fill Out, Sign Online and Download Fillable PDF, Hawaii

Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only.

Fillable Form N15 Individual Tax Return Nonresident And PartYear Resident State Of

2014) art c 2014 or nol ear t thru for office use only b. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not.

Form N15 Exercise University of Hawaii J1 State of Hawaii Tax March 18, ppt download

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a.

Fillable Form N11/n13/n15 Schedule X Tax Credits For Hawaii Residents 2010 printable

Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art.

NI15 Employment Identity Document

2014) art c 2014 or nol ear t thru for office use only b. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a.

20202022 Form HI DoT N288C Fill Online, Printable, Fillable, Blank pdfFiller

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form.

15 Document Form Fill Out and Sign Printable PDF Template signNow

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a.

Form N15 Individual Tax ReturnNonresident And PartYear Resident 2002 printable pdf

2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line.

Download New 15G 15 H Forms

Web form state of hawaii department of taxation 1 t (rev. 2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a.

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. 2014) art c 2014 or nol ear t thru for office use only b. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n. Web form state of hawaii department of taxation 1 t (rev.

2014) Art C 2014 Or Nol Ear T Thru For Office Use Only B.

2020) page 3 of 4 38 if you do not itemize deductions, enter zero on line 39 and go to line 40a. Web form state of hawaii department of taxation 1 t (rev. Web 87 rows any person who is not required to register as a “verified practitioner” must use their full social security number on form n.