West Virginia Sales Tax Exemption Form

West Virginia Sales Tax Exemption Form - Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption. Send the completed form to your. Do not send this form to the streamlined sales tax governing board. Web the following sales and services are exempt “per se” from sales and use tax in west virginia: Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases.

Form ST10. Sales and Use Tax Certificate of Exemption (Virginia) Forms Docs 2023

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web the following sales and services are exempt “per se” from sales and use tax in west virginia: Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Send the.

West Virginia Tax Exempt

Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Send the completed form to your. Web the following sales and services are exempt “per se” from sales and use.

Form ST11 Download Fillable PDF or Fill Online Sales and Use Tax Certificate of Exemption

Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption. Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Do not send this form to the streamlined sales tax governing board. Web sales tax is imposed on the.

West Virginia Affidavit for Exemptions Personal Property Tax Exemption Affidavit Wv US Legal

Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Web the following sales and services are exempt “per se” from sales and use tax in west virginia: Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Do.

Wv sales tax exemption form instructions Fill out & sign online DocHub

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Do not send this form to the streamlined sales tax governing board. Web sales tax is imposed on the.

Form Cst200cu West Virginia Sales And Use Tax Return printable pdf download

Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed.

Nonprofit Sales Tax Exemption Form Wv

Do not send this form to the streamlined sales tax governing board. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web the following sales and services are exempt.

Virginia Sales And Use Tax Certificate Of Exemption Form

Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption. Web the following sales and services are exempt “per se” from sales and use tax in west virginia: Send the completed form to your. Web sales tax is imposed on the sale of goods and services by the vendor at.

Form F0003 Fill Out, Sign Online and Download Printable PDF, West Virginia Templateroller

Do not send this form to the streamlined sales tax governing board. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption. Send the completed form to your. Web •some.

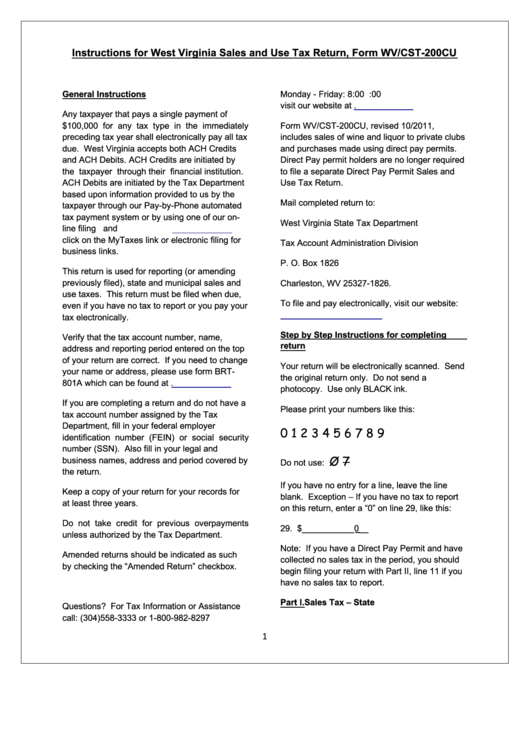

Instructions For West Virginia Sales And Use Tax Return, Form Wv/cst200cu printable pdf download

Send the completed form to your. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Do not send this form to the streamlined sales tax governing board. Web the.

Send the completed form to your. Do not send this form to the streamlined sales tax governing board. Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Web the following sales and services are exempt “per se” from sales and use tax in west virginia: Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption.

Web The Following Sales And Services Are Exempt “Per Se” From Sales And Use Tax In West Virginia:

Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases. Send the completed form to your. Web •some tax exemptions may be claimed by presenting a properly executed certificate of exemption (form f0003) to the vendor of. Web sales tax is imposed on the sale of goods and services by the vendor at the time of purchase.

Do Not Send This Form To The Streamlined Sales Tax Governing Board.

Web tax must be collected on a sale of taxable personal property or taxable services unless a properly completed exemption.